Diversification

We work with you,

not only with your assets

Why diversification

Asset Allocation aims to optimise risk adjusted returns. Diversification is key to achieve this goal

Tržišta dionica u razvoju (Emerging Markets Equities)

Veliki povrati nakon određenog vremenskog razdoblja, uz veći rizik.

Veliki povrati nakon određenog vremenskog razdoblja, uz veći rizik.

Cash and Short Maturity Bonds

Emerging Markets Bonds

Investment Grade Corporate Bonds

Emerging Market Bonds

High Yield Bonds

Developed Market Equities

Emerging Markets Equities

Commodities

Real Estate

Alternnative Trading Strategies

Trade-off between risk, liquidity and return

The three main objectives of an investment - highest level of security, liquidity and rate of return cannot be achieved simultaneously. The investors must define which objective takes the priority, in accordance with their own preferences.

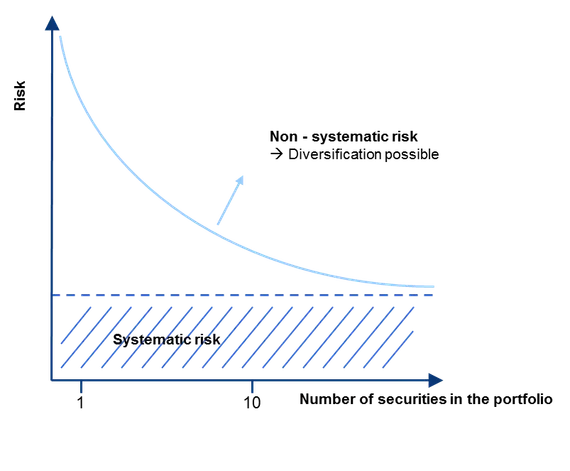

Diversification can significantly reduce unsystematic risks (distribution of assets in different asset classes).

The investor has no influence over systemic risks, or over natural disasters or wars, but the portfolio manager is required to manage the client's portfolio in a professional manner, in the best possible way, with the attention of a good businessman.

Our products and services

Discretionary Portfolio Management

Funds

Treasury

Erste Gold packages

Research

Reporting to clients

Custody

Send us an inquiry!

Please contact us with confidence.

Our private bankers will contact you as soon as possible.